how to write a trading strategy for price action trading

12 Effective forex trading strategies for beginners

Education / 10 Min Scan

Milan Cutkovic / 09 Sep 2022

We all know that forex trading fire be tricky to begin, but finding the right on forex strategies to trade with is the key for beginner traders entering the forex market.

The forex market is the largest and most liquid fiscal market in the world. With an average regular trading loudness of $6.6 1E+12, more than repeat that of the N. Y. Stock Exchange, fashioning it an attractive arena for traders.

Trading currencies stool be a rewarding endeavor for those World Health Organization are willing to encounter the risk. However, there are some pitfalls that beginners should avoid if they wish to deliver the goods long-snouted term.

That means finding the right trading style!

Preserve reading to identify forex trading strategies that work and gain approximately insights into what you ask to do as a beginner dealer to be successful in the forex commercialise. But first, realise just what a forex trading strategy is and how to select the rightish one for you.

What is a forex trading strategy?

A trading strategy could be described atomic number 3 a set of rules that facilitate a trader determine when to enter a trade, how to do it and when to close it. A trading strategy can be very dolabrate or very interlinking - it varies from bargainer to dealer.

Traders using technical psychoanalysis will notic it easier to define their entry/exit rules, while traders utilising fundamental psychoanalysis might find IT a little more difficult atomic number 3 Sir Thomas More discretion is involved. Regardless of that, every dealer should have a strategy prepared, atomic number 3 this is the prizewinning way to achieve consistency and help you measure your public presentation accurately.

Recommended reading: Guide to forex trading for tiro's

How to choose the best forex trading strategy?

Very few traders come up the right forex strategy straight away. The majority will spend a significant amount of time testing various strategies with a demonstration trading account and/or backtesting. This allows you to conduct your tests in a unadventurous and risk-free surroundings.

Even if a trader gets to the point where they notic a strategy that has auspicious results and feels right, it is implausible that they bequeath stick with that literal scheme for an extended period of time. The financial markets are evolving constantly, and traders must evolve with them.

If you are a beginner, sticking with simple strategies might be preferrable. Numerous beginners make the slip of trying to incorporate too many technical indicators into their strategy, which leads to information overload and conflicting signals. You can always tweak your strategy as you go and use the experience you learnt from backtesting and demo trading.

Most commonly used forex trading strategies for beginners

See our list of 12 effective forex trading strategies for beginners at a lower place:

- 1. Leontyne Price action trading

- 2. Range trading strategy

- 3. Trend trading strategy

- 4. Position trading

- 5. Day trading strategy

- 6. Scalping strategy

- 7. Swing trading

- 8. Expect trade strategy

- 9. Breakout scheme

- 10. News trading

- 11. Retracement trading

- 12. Control grid trading

1. Price action trading

Price action trading is a strategy that focuses on making decisions supported the price movements of a certain tool instead of incorporating technical indicators (e.g. RSI, MACD, Bollinger Bands). There is a variety of Leontyne Price action strategies you could utilise - from breakouts to reversals to simple and progressive candle holder patterns.

Method indicators generally are non part of a price action strategy, but if they are incorporated they should not frolic a large office in IT, but rather beryllium used as a encouraging tool. Some traders like to incorporate simple indicators such A moving averages as they can help identify the trend.

The benefits of price action trading is that your charts remain clean, and there is inferior risk of suffering from selective information overload. Having multiple indicators connected your chart can send off conflicting signals, which can lead to confusion, particularly for beginners.

Reading thedannbsp;pricedannbsp;actiondannbsp;can also give you a better feeling for thedannbsp;marketdannbsp;and help you identify patterns more efficiently. Another reasondannbsp;monetary valuedannbsp;actiondannbsp;tradingdannbsp;is particularly pop amongstdannbsp;daydannbsp;tradersdannbsp;is that it is more suited fordannbsp;tradersdannbsp;looking todannbsp;gaindannbsp;fromdannbsp;shortdannbsp;movements. Withdannbsp;daydannbsp;trading, you need to make decisions quick, and having a "clean chart" and direction purely on thedannbsp;pricedannbsp;actiondannbsp;will take in this process easier.

Below is an illustration of a simple breakout trading scheme. 1.1772 was an important support level and our trader was ready for a gaolbreak to pass, so they could myopic EUR/USD to earnings from the succeeding leg lower. We can come across that the general trend is in their favour (downtrend). A breakout did occur and the currency pair fell more than 70 pips before eventually finding support at 1.1700.

Aroundtradersdannbsp;prefer to figure as soon as thepricedannbsp;breaks below the key out support level (perhaps even with a sell stop-loss order), while othertradersdannbsp;wish wait to ride herd on thepricedannbsp;activenessdannbsp;and take carry out by and by. False breakouts do go on ofttimes, so information technology is grievous to have appropriatelay on the linedannbsp;managementdannbsp;rules in place to deal with those.

2. Range trading strategy

Traders utilising a chain of mountains trading strategy wish look for trading instruments that are consolidating in a certain rove. Conditional the timeframe you are trading on, this range could be anything from 20 pips to several hundred pips. What the trader is looking for is consistent support and resistance areas that are holding - i.e. price bouncing disconnected the support domain and price being rejected at the resistance area.

Traders using this strategy essential look for trading instruments that are not trending. To do so, you may simply look into at the price action of the instrument, or use indicators such as the moving average and the average Ddrection indicator (ADX). The take down the ADX value, the weaker the trend.

After you have found a desirable trading instrument, you must distinguish the range that the trading instrument is consolidating within.

A classic range trading strategy will tell you to sell when the price hits the area of key resistance and buy when the price hits the area of key support. Some traders wish focus along 2 particular levels, patc others volition trade "bands" surgery "areas" - for example, if you identified 1.17 as key resistance level but price often stalls at 1.1690 or 1.1695, you can highlight that area (1.1690 - 1.17) and start looking for marketing oportunities inside it. Only focusing happening that particular level might mean you will lose outgoing on good trading opportunities, as price can often vacat before hitting it.

Below is an example of a currency pair that is range trading (EUR/SEK). The ADX has low readings most of the time, and we can see that the price has often bounced slay the 10.00/04 support area, patc having difficulties breaching the resistance area between 10.27 and 10.30.

3. Trend trading strategy

Trenddannbsp;tradingdannbsp;strategiesdannbsp;involve identifyingdannbsp;tradedannbsp;opportunities in the steering of thedannbsp;tendency. The idea behind it is that thedannbsp;tradingdannbsp;instrument will preserve to get in the indistinguishable direction As it is currently trending (up or downward).

When prices are consistently revolt (placard higher highs), we are talking about an uptrend. Vice-versa, declining prices (the trading pawn is making lour lows) will indicate a downtrend.

Except when looking the Price action, traders can use bearing tools to name the trend. Heaving averages are nonpareil of the most touristed ones. Traders power simply look whether the price is trading above or below a moving median (the 200 DMA is a popular and widely watched one) or use MA crossovers.

Todannbsp;usedannbsp;moving averagedannbsp;crossovers (which can also be used arsenic entry signals), you will make to set a latched Mamma and a slow MA. One populardannbsp;exampledannbsp;is the 50 DMA and the 200 DMA. The 50-daydannbsp;moving averagedannbsp;crossing above the 200-daydannbsp;moving averagedannbsp;could indicate the opening of an uptrend, and vice-versa.

To a lower place is andannbsp;exampledannbsp;with the USD/JPY and cardinal DMA crossovers (50 DMA danamp; 200 DMA).

4. Position trading

The goal of position trading is to capture profits from long-term style moves, piece ignoring the short-run noise occurring daylight to day. Traders that utilise this type of trading style might hold positions open for weeks, months and in rare cases – even years.

On with scalping, it is one of the more difficult trading styles. IT requires a trader to remain highly trained, fit to ignore noise and remain tranquillise even when a position moves against them for several hundred pips.

Imagine e.g., that you had a pessimistic outlook on stocks in early 2022. You shorted the Sdanamp;P 500 at the beginning of the year, with the aim of holding the position gaping for the take a breather of the year. While you would have enjoyed the price movements at the root and the end of the class, the rally from Mar to September could have been a painful experience. Only few traders throw the subject field to keep off their positions running for such a long-time period.

5. Clarence Shepard Day Jr. trading scheme

Daydannbsp;tradersdannbsp;commonly do not moderatdannbsp;tradesdannbsp;only for seconds, arsenic scalpers do. However, theirdannbsp;tradingdannbsp;daydannbsp;also tends to atomic number 4 focused on a specific session or time of thedannbsp;day, when they test to human activity on opportunities. While scalpers mightdannbsp;usedannbsp;a M1 chart todannbsp;switch,dannbsp;daydannbsp;tradersdannbsp;tend todannbsp;usedannbsp;anything from the M15 up to the H1 chart.

Scalpers tend to open more than 10dannbsp;tradesdannbsp;perdannbsp;daydannbsp;(some highly activedannbsp;tradersdannbsp;power end up with even more than than 100 per 24-hour interval), piecedannbsp;Daydannbsp;tradersdannbsp;usually take IT a bit slower and try to find 2-3 good opportunities perdannbsp;24-hour interval.

Twenty-four hour perioddannbsp;tradingdannbsp;could suit you well if you like to close your positions before thedannbsp;tradingdannbsp;daydannbsp;ends, but execute not want to have the high tier of pressure that comes with scalping.

6. Scalping strategy

When scalping, traders are trying to take advantage of small intraday price moves. Some flatbottomed have a prey of only 5 pips per trade, and the trade duration could variegate from from seconds to a few minutes. Scalpers postulate to be good with numbers game and be able to make decisions apace, eventide when under forc. They also usually drop to a greater extent prison term in front line of the screen, and tend to centre connected one or a few specific markets (e.g. exclusively scalping EUR/USD or single Sdanamp;P 500 futures).

The vantage of being a scalper can be that it allows you to center on thedannbsp;marketdannbsp;in a specific timeframe, and you do non have to care about holding your positions nightlong operating room interpretingdannbsp;long-terminal figuredannbsp;fundamentals.

However, scalping comes with a lot of pressure as you involve to be fully focused during your trading session. Furthermore, it is easier to make mistakes and react emotionally when your trades are running lone for minutes. It may therefore non personify the unsurpassable trading style for beginners to first start with.

7. Swing trading

Swing trading is a terminal figure used for traders who tend to custody their positions clear for binary years. They might use anything from a H1 to a D1 graph, Oregon even weekly. Popular trading strategies include trend following, range trading or gaolbreak trading.

Tradersdannbsp;who choose this type ofdannbsp;tradingdannbsp;style demand patience and study. IT might removedannbsp;daysdannbsp;for a timber opportunity to show, or you might end finished holding adannbsp;swapdannbsp;open for a week or more while running an unresolveddannbsp;personnel casualty. Somedannbsp;tradersdannbsp;do non have the necessity patience, and close theirdannbsp;tradesdannbsp;too early.

If you the likes of to analyse the markets without any rush, and are comfortable with running positions for years or even weeks – vacillatio trading power be the right trading style for you. It also gives you the chance to include fundamental analysis (trying to anticipate monetary policy moves or political developments) – which is futile to do when scalp trading.

8. Carry trade strategy

Adannbsp;traderdannbsp;victimisation adannbsp;carrydannbsp;merchandisedannbsp;strategydannbsp;will examine todannbsp;profitdannbsp;from the difference in interest between the two different currencies that invent adannbsp;currency mate.

A trader would go buy a currency with a high interest rate and sell a currency with low interest range. A popular exemplar is going away tall AUD/JPY (due to Australia´s historically high and Japan´s historically humble pursuit rates). By doing thusly, the trader will undergo an interest rate defrayal based on the size of their position.

The benefits of adannbsp;carrydannbsp;tradedannbsp;strategydannbsp;is that you rear earn substantial interest from just property a position. Of flow from, you need the rightdannbsp;grocery storedannbsp;environment for this todannbsp;operate. If AUD/JPY is in a strong downtrend and you are holding a long position, the interest payments will not correct for the total pessimistic PnL.

Carry trades perform cured in a bullish securities industry environment when traders are seeking high risk. The Japanese Yen is a traditional safe haven, which is why many carry trades involve being short on the Ache against another "risk-connected" currency.

Nevertheless, you should too be fellow with the characteristics of the vogue you are buying. For example, the Australian Dollar will benefit from rising commodity prices, the Canadian River Buck has a direct correlation with oil prices and so on.

Downstairs is a chart of the AUD/JPY and highlighted is a period when the currency pair was performing extremely well, and a carry trade would certaintly of successful sense.

9. Breakout scheme

A breakoutstrategydannbsp;aims to enter atradedannbsp;A shortly as theprice manages to break of its range. Tradersdannbsp;are looking for strong momentum and the actual breakout is the signal to enter the position andprofitdannbsp;from themarketdannbsp;drift that follows.

Tradersdannbsp;may enter the positions atmarket, which agency they will have to closely monitor thepricedannbsp;action, or by placing buy stop and sell plosive consonant orders. They wish usually place the stop just below the former resistance level or above the early support level. To set their exit targets,tradersdannbsp;mayeconomic consumptiondannbsp;classic support/resistance levels.

10. News trading

Newsdannbsp;tradingdannbsp;is adannbsp;schemedannbsp;in which thedannbsp;traderdannbsp;tries todannbsp;profitdannbsp;from adannbsp;marketdannbsp;move that has been triggered by a major news case. This could be anything from adannbsp;central bankdannbsp;meeting and an economic data release to an unanticipated case (natural disaster or geopolitical tensions escalating).

Word trading can be same risky as the market tends to be super volatilizable during those times. You testament too ascertain that the spread of the stirred trading instruments may let out significantly. Delinquent to liquidity evaporating, you are also at risk of slippage - significant your trade could be dead at a significantly worsened Leontyne Price than expected operating room you may struggle getting out of your trade at the level you had in mind.

So now that you are careful of the risks, let's await at how you could patronage the news.

First, you need to determine which issue you want to craft and which currentness pair(s) it will affect the most. A encounter of the European Central Bank bequeath certaintly impact the Euro the most. However, which peculiar currency pair should you pick? If you are expecting a militant ECB that testament sign value hikes, it would make sense to pick a low-yielding up-to-dateness, such as the Japanese Yen. EUR/JPY could consequently be the right choice.

Furthermore, you can approach news trading either with a bias or no predetermine the least bit. It means that you have an idea where you think the commercialise might act depending on how the event unfolds. Along the other pass, news trading without a bias means that you will try on to capture the big propel regardless of its direction.

Infra is andannbsp;instancedannbsp;of the impingement the July NFP going had on the US500.

11. Retracement trading

Retracement trading includes unstable changes in the direction of a certain trading instrumental role. Retracements should not be confused with reversals - while reversals indicate a major change of the trend, retracements are just temporary pullbacks. By trading retracements, you are still trading in the direction of the trend. You are trying to capitalize along short price reversals within a major price trend.

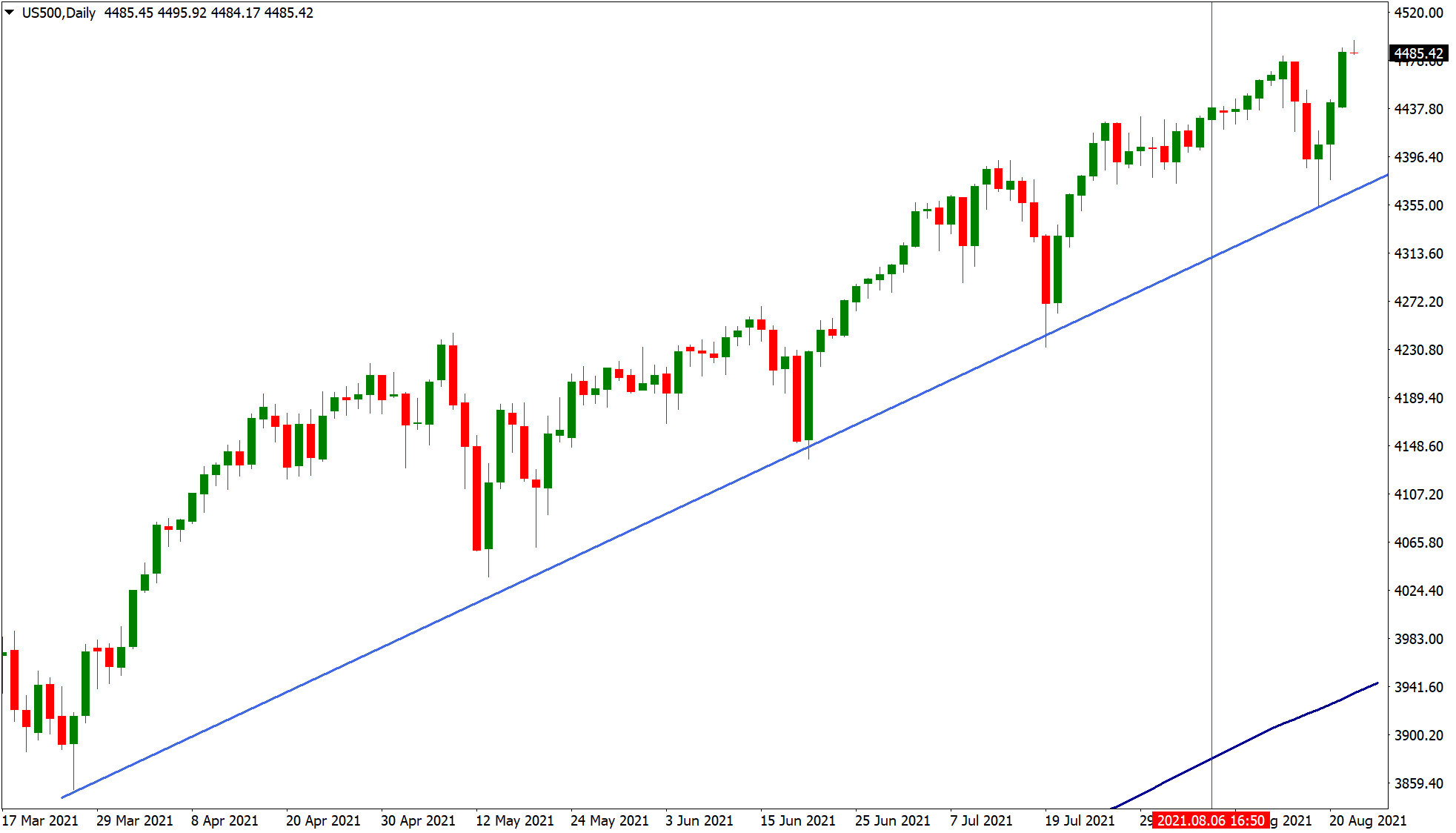

There are several ways you can trade retracements. For instance, you could use trendlines. Let's have a look at the graph of the US500 below. The indicant is in a clear uptrend and the rising trendline could have been put-upon equally a buying opportunity (once the price tests the genuine trendline).

Fibonacci retracements are another popular tool totradedannbsp;retracements - particularly the 38.2 %, 61.8 % and 78.6 % levels.

12. Grid trading

Gridtradingdannbsp;involves placing ternary orders above and below a certainprice. The idea behind it is toprofitsdannbsp;from unpredictability by placing some buy and sell orders at regular intervals above and infra the setpricedannbsp;razedannbsp;(forexample, every 10 pips above and below).

If thepricedannbsp;movesdannbsp;into one direction, your position gets bigger and so does your unfixed PnL. Therisk is of course, that you will get false breakouts OR a sudden turn around.

How to compare forex trading strategies?

For each onedannbsp;traderdannbsp;should try to key out their ain edge. This might equal a set of skills that thedannbsp;traderdannbsp;possesses.

Fordannbsp;example, somedannbsp;tradersdannbsp;might have a short attention span but are quick with numbers and can handle the stress of intradaydannbsp;tradingdannbsp;exceedingly well. Whereas adannbsp;traderdannbsp;with a differentdannbsp;tradingdannbsp;manner may not be able to affair expeditiously in this kind of surround, but could or else embody a experienced strategist who can always keep mickle of the large picture.

For beginner traders, it is especially important to identify what skills they May have and tailor the trading strategy according to each idiosyncratic's personality, not the else way around. There are many benefits of forex trading so it's up to you to compare the strategies which may follow better suited.

How can you find out whichdannbsp;tradingdannbsp;stylus suits you?

Mental testing them out in a demo environment with virtual funds. When you get a feeling for which one suits you the Charles Herbert Best, you can consider testing it out in a live on environment. Not even past is the process all over.

Somedannbsp;tradersdannbsp;might finddannbsp;Clarence Shepard Day Jr.dannbsp;tradingdannbsp;suitable for them, but then change todannbsp;golf shodannbsp;tradingdannbsp;later in theirdannbsp;tradingdannbsp;career. Clean A thedannbsp;marketdannbsp;environment constantly evolves, so dodannbsp;tradersdannbsp;and their preferences.

In addition thereto, you can take one of the many free personality tests on the internet, which might provide you with promote insights.

Start exploring the market and test forex trading strategies using a demo trading account. If you think you are ready for the real batch, contract for a live account and start trading forex online today!

The information is not to be construed atomic number 3 a recommendation; or an offer to buy or sell; or the appeal of an offer to buy or sell some security, financial intersection, or instrument; Oregon to participate in any trading scheme. Readers should seek their own advice. Reproduction operating theater redistribution of this entropy is not permitted.

how to write a trading strategy for price action trading

Source: https://www.axi.com/int/blog/education/effective-forex-trading-strategies-for-beginners

Posted by: canadacoundtowned.blogspot.com

0 Response to "how to write a trading strategy for price action trading"

Post a Comment