understanding options and basic trading strategies

Option Trading Strategies? Sounds heavy? Already worrying you? Well, fret non! We shall help you crack this one quite an easily.

Let's start away aside discussing the good example of the game "lotto" where we gage a lottery ticket and the odds of winning the lottery are selfsame low. However, if we gain we hit a jackpot. Similarly, when we trade-in options, we know it involves a certain floor of risk but we still participate in them with the prevision of a jackpot like the game above. But if you look at modern options traders, they generally treat options as a hedging tool or as a strategising instrument where the goal is to maximise profits while minimizing losses. That's on the button where one wants to be!

In reality, there in spades exists some option trading strategies and these option trading strategies are premeditated in such a way that limits the risk quotient and opens a portal to unlimited profits.

In this web log, we shall discourse 12 such choice trading strategies that every monger should be aware of when trading in options.

- 12 types of option trading strategies:

- 1. Bull Call Disperse:

- 2. Papal bull Put Spread:

- 3.Call Ratio Rearmost Spread:

- 4. Polysynthetic Call:

- 5. Bear Telephone call Spread:

- 6. Bear Put Spread:

- 7. Rifle:

- 8.Synthetic Put:

- 9.Long danamp; Stumpy Straddles:

- 10. Long danamp; Runty Strangles:

- 11.dannbsp;Long danamp; Short Butterfly:

- 12.Interminable danamp; Short Iron Condor:

First things first, let's find out what this heavy options related jargon means. Thus what are pick trading strategies?

Option Trading Strategies refer to purchasing calls or put options or selling calls or arrange options Oregon some together for the purport of limiting losses and gaining untrammelled profits. Basically, utilising one or more than combinations for the best outcome possible based on our defined parameters.

Call up options give the bearer the right but not an duty to buy the rudimentary livestock whereas put off options give the owner the ripe, simply not the obligation, to sell the underlying stock at a pre-ambitious price by a arranged expiration time.

Option Trading Strategies can be classified into optimistic, bearish or electroneutral option trading strategies. Sounds interesting until here? Well, there's Sir Thomas More to get your agitation levels raised.

Presenting to you 12 types of option trading strategies every trader should know and can use to level upfield the game of their pick in the livestock securities industry!

12 types of option trading strategies:

Everyone loves a bull grocery and we look maximum retail participation in the stemm marketplace when the indices are running high so we head start polish off with Bullish Option Trading Strategies:

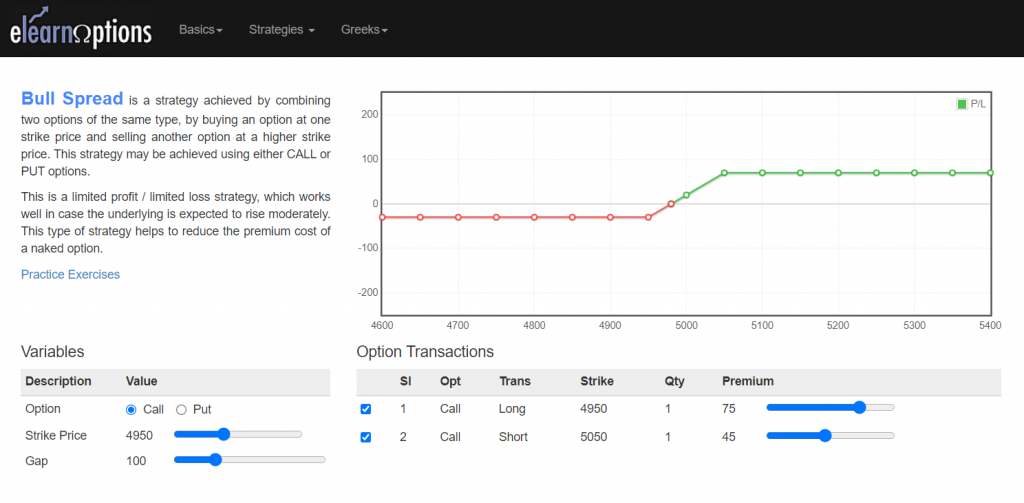

1. Bull Call Spread:

A bull cry spread is peerless of the bullish selection trading strategies that involve buying one At-The-Money (ATM) call alternative and selling the Out Of-The-Money call option.

One should remark that both the calls should have the same underlying stock and the Same termination date.

In this strategy, profit is made when the cost of the underlying stock increase which is equal to spread minus net debit and going is incurred when the stock price falls which is equal to the net debit. Net Debit is capable the Premium Paid for a lower ten-strike disadvantageous the Agiotage Conventional for a higher strike. The Spread refers to the difference between the higher and bring dow hit price

Copper Cry Spread helps in protecting when the prices fall and the profit sum is also limited.

From the above example from elearnoptions, we can say that both the profit and loss is capped.

This strategy Acts as a great alternative to exactly purchasing a call when the traders are not aggressively bullish on a stockpile.

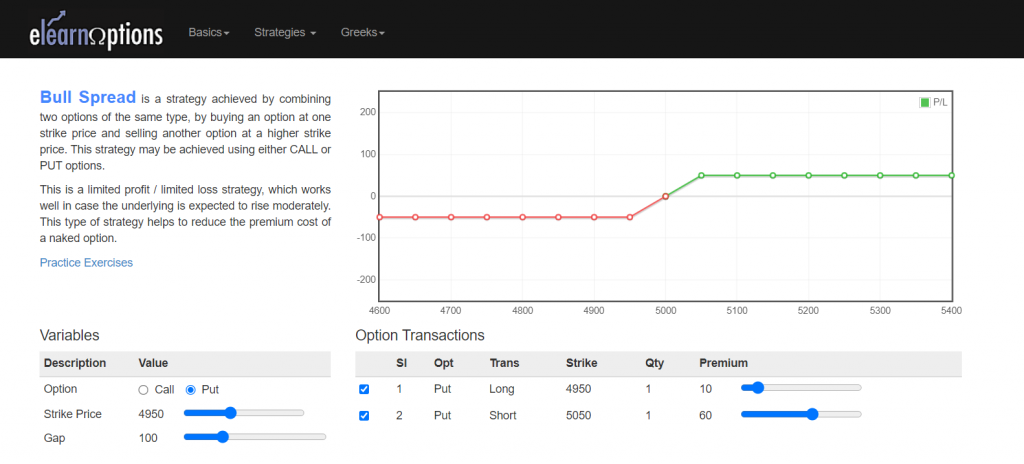

2. Bull Put Spreadhead:

This is one of the optimistic option trading strategies that options traders can implement when they are a trifle bullish along the bowel movement of the underlying asset.

This strategy is similar to the bull foretell spread in which rather of purchasing calls we bribe puts. This strategy involves purchasing 1 OTM Put choice and selling 1 ITM Put option.

One should note that both puts should have the same underlying stock and besides the same loss date.

A Taurus put spread is formed for a net credit or net number received and it incurs gain from a new stock cost that is limited to the net credit received, on the past helping hand, the potential expiration is limited and occurs when the toll of the stock falls below the strike cost of the long put.

3.Call Ratio Back Spread:

The Call Ratio Back Spread is one of the simplest option trading strategies and this strategy is implemented when one is very bullish along a inventory or index.

In this strategy, traders can make unlimited profits when the market goes up and specific profits if the market goes down. The loss is made entirely if the market corset within a specific ambit. In other words, traders can make a net profit when the marketplace moves in either direction.

This scheme is a 3 leg strategy that consists of buying two OTM call options and selling one ITM call option.

We can go steady from the above P/L diagram that we realize lucre when the price goes in either of the directions.

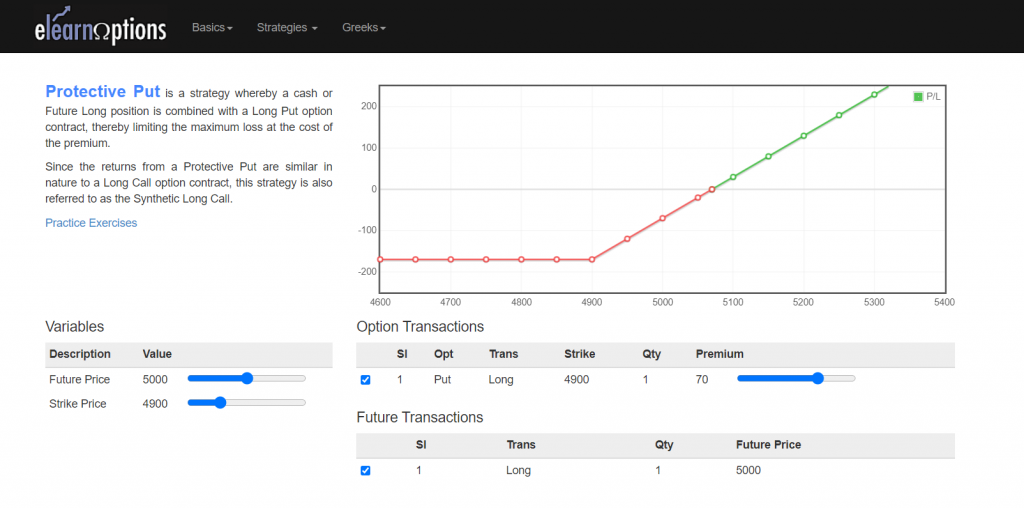

4. Counterfeit Call:

A Synthetic Call is one of the option trading strategies is used by those traders who have a bullish view of the stock for the long term but are as wel troubled about the downside risks at the same time. This strategy offers unlimited potential profits with narrow put on the line.

The scheme involves buying put options of the origin that we are property and on which we have a bullish consider. If the price of the underlying rises, then we shall make profits whereas if the price falls then the loss will be limited to the premium that is paid for the put option. This strategy is similar to the Antifouling Put options strategy.

From the above payoff diagram, we seat see the put on the line is controlled to the premium whereas the potential profit is unlimited.

Translate more about Options Trading Strategies from our ELM School Mental faculty

Well, the world works happening demand and supply, and thus does the stock market. When you catch people flying altissimo during a bullish market, there is always a dispense look at bearish option trading strategies. There is always a group of "Manu Mandoriyas" (Character reference: Scam 1992) hoping for a downside. Thus, let's take the discussion further and consider bearish option trading strategies.

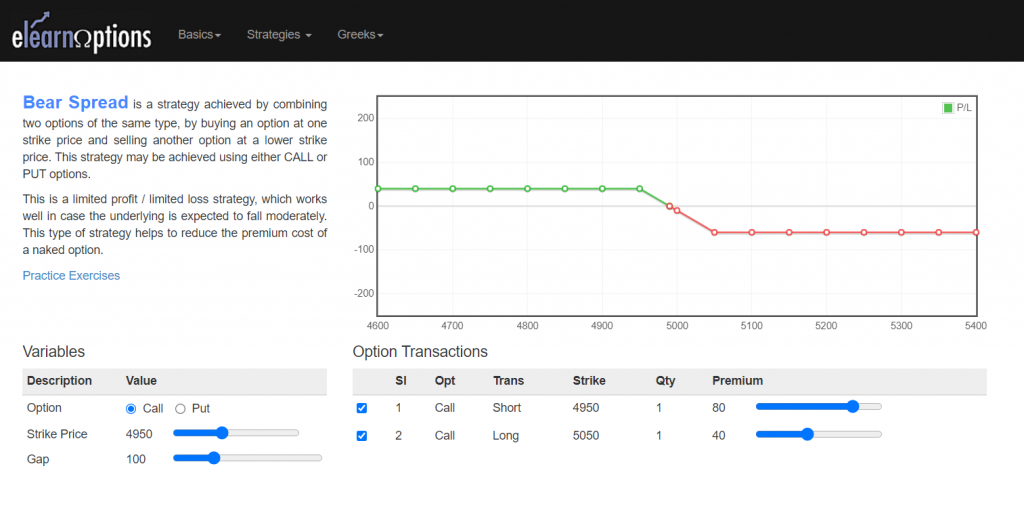

5. Bear Call Spread:

The Bear Call Spread is one of the 2-leg option trading strategies that is implemented by the options traders with a 'moderately pessimistic' view on the market.

This strategy involves purchasing 1 OTM Call option i.e a high bang price and selling 1 ITM Call option i.e. a lower strike Leontyne Price. One should note that some the calls should have the same underlying store and too the same expiration date.

A bear call spread is cross-shaped for the net credit and profit are made from this strategy when the stock prices pin. The potential lucre is limited to the net credit and potential loss is limited to the spread harmful mesh credit. The Take-home Citation equals thedannbsp;Premium Received minus the Exchange premiu Paid.

From the above P/L plot, we can see that this strategy involves limited gains which are adequate the nett acknowledgment and loss is limited which is equal to the spread minus the net mention.

6. Bear Set Spread:

This strategy is quite akin to the Bull Call Bedspread and also quite easy to implement. Traders would apply this scheme when the view of the market is somewhat bearish, i.e when the traders are expecting the market to go down but not too much.

This scheme involves purchasing the ITM Put pick and selling the OTM Put under alternative. One should note that both the puts should have the comparable underlying stemm and the same expiration date stamp. This strategy is formed for a internet debit or profit cost and profits as the underlying stock falls in monetary value.

From the to a higher place diagram, we can pronounce that the profit is limited and equal to the spread minus the internet debit and the loss is coequal to net debit. The Net Debit equals the Premium Paid minus Premium Received.

7. Strip:

A strip is bearish to a neutral options strategy that involves buying 1 Cash dispenser Call and 2 ATM Puts.

One should note that these options should be bought on the same underlying, and also with the same strike price and aforementioned expiry go steady.

Traders can earn profits when the price of the underlying stock price makes a strong draw in the up or down direction at the time of expiration, but generally, huge profit are earned when the prices move down.

As we can see from the above example, the supreme profit is unlimited and the total loss associated with this strategy is limited to the net premium paid.

8.Synthetic Put option:

Synthetic put is one of the option trading strategies that is implemented when investors have a pessimistic though of the stock and are concerned about potential go up-term strength in that stock.

The profit from this strategy is made when on that point is a pass up in the underlying stock's price, which is why this strategy is also known as the synthetic nightlong put option.

The synthetic long put is so named as this scheme has the same profits potency arsenic long put under.

From the above example, we can see that the maximum profit is unlimited and the maximum loss.

You can also view our webinar on MASTERCLASS WEBINAR Serial publication: TRADING STRATEGY WITH OPTIONS BY CHETAN

So, we've seen bullish and bearish pick trading strategies simply what about the ones that make nobelium posture? On that point are always a bunch of people who don't see any exonerate one-sided direction in the unreal full term and want to remain unaffected by the same. Well, there are neutral strategies for so much views where profits Don River't depend on the market direction.

9.Long danamp; Sawn-off Straddles:

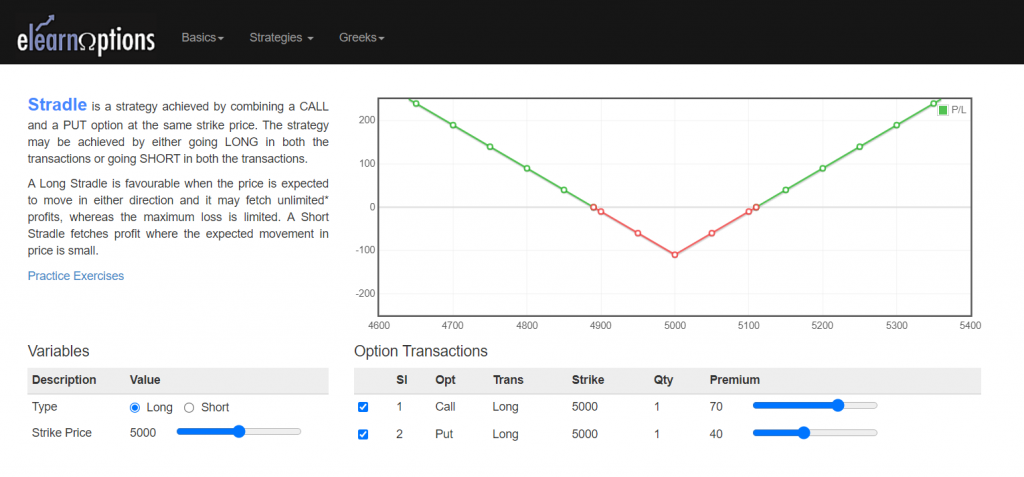

The long range is one of the simplest market neutral option trading strategies to implement and when implemented the Pdanamp;L is not affected aside the direction in which the market moves.

This scheme involves purchasing the ATM Call and Put options. Combined should note that both the options should dwell to the same underlying, should accept the said expiry and also belong to the same strike.

As we examine from the above image, the profits are unlimited and the loss is minor.

Short Straddle involves selling the ATM Prognosticate and Put option as opposed to Extendable Straddle. Here, the net profit is equal to the total premium received and maximum loss is unlimited American Samoa shown below:

10. Long-run danamp; Improvident Strangles:

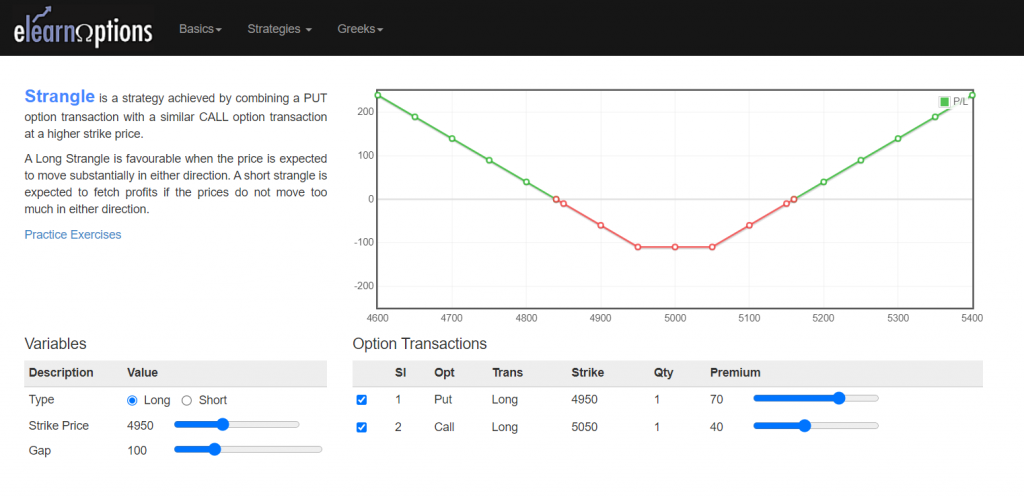

The strangle is similar to the span but the only deviation betwixt them is that- in a straddle, we are required to buy call and put off options of the ATM strike price whereas the strangle involves buying OTM call and position options.

Prolonged Strangle involves purchasing one OTM put and single OTM ring option. Here, the profit is unlimited and the maximum loss is equal to the network agio flow.

Whereas the Short Stifle involves selling a set up and call OTM options. From the below deterrent example, we can see that the maximum loss is unlimited arsenic the Price rises or falls and the maximal profit is equal to the total premium received.

11.dannbsp;Long danamp; Short Butterfly:

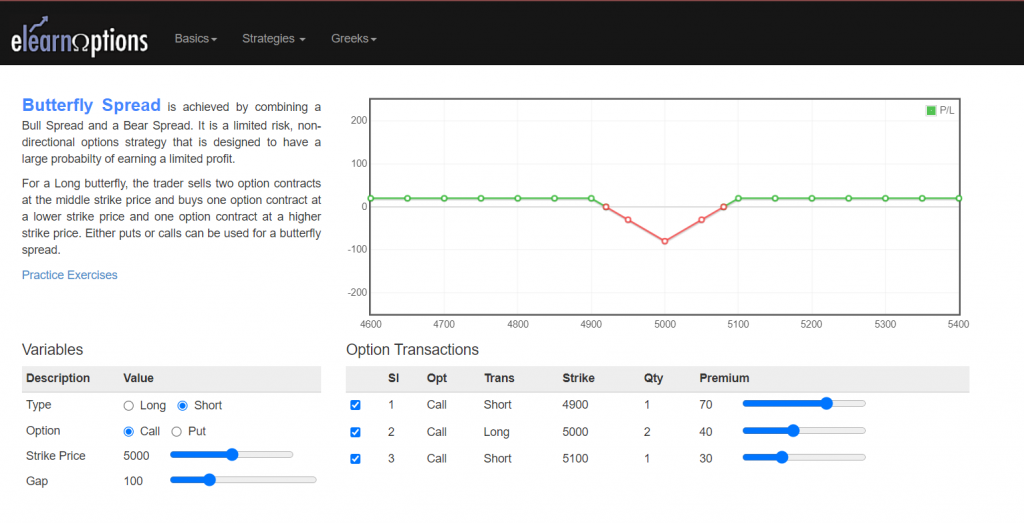

A butterfly spread is one of the neutral option trading strategies that combine Taurus the Bull and bear spreads, with a fixed risk and finite profit. The options with higher and lower strike prices have the said distance from the at-the-money options.

The elongated butterfly call spread involves: Purchasing one ITM call off option, writing ii ATM call options, and then purchasing one OTM call selection.

The squat butterfly spread scheme involves selling single in-the-money call option, buying two at-the-money call options, and selling an out-of-the-money phone option.

You terminate also join our course connected CERTIFICATION IN ONLINE OPTIONS TRADING STRATEGIES

12.Long danamp; Short Iron Condor:

An iron condor is one of the pick trading strategies that consists of two puts (one long-lasting and one short) and deuce calls (one long and ace short), and iv assume prices. All moldiness have the same expiration date.

The maximum profit is incurred when the underlying asset closes between the middle strike prices at expiration.

Look out our video on Option Trading Strategies:

We hope you enjoyed this blog on pick trading strategies. Show extraordinary love past sharing this web log and serving US in our mission of spreading financial literacy. Happy Investing!

understanding options and basic trading strategies

Source: https://www.elearnmarkets.com/blog/12-must-know-option-trading-strategies/

Posted by: canadacoundtowned.blogspot.com

0 Response to "understanding options and basic trading strategies"

Post a Comment