Low Spread Forex Brokers Scalping

Picking a Low Spread Forex Banker or Zilch Spread Account is essential, especially for Forex trading and scalping. Paying less, cuts trading costs in the long run, especially if you are an active trader. We've put together this listing of the best brokers to make things easier for you lot. We nerveless trustworthy brokers who are regulated and accept a strong reputation.

Table of contents

- 1 What are Everyman Spread or Zero Spread Brokers?

- 2 Tiptop 10 Lowest Spread Forex Brokers

- 3 Compare Forex Costs per 100,000 Traded

- 4 1. Pepperstone – Everyman Spread Accounts and Best Overall

- 4.ane Pepperstone Quick Facts

- iv.2 Pepperstone Accounts

- 5 2. AvaTrade

- 6 3. FP Markets

- 7 4. IC Markets

- 8 v. Forex.com

- 9 six. FXTM

- ten What is Spread in Forex?

- 10.1 How does Spread piece of work in Forex?

- 10.two How are spreads calculated?

- 10.3 How to Spread Bet in Forex?

- 11 What is considered proficient spread?

- 11.i What is the lowest spread in Forex?

- eleven.ii What is a null spread account?

- 12 How To Compare Low Spread Accounts?

- 12.1 Raw Spread Business relationship vs Standard Account

- 13 How does a good spread make a departure?

- 14 Scalping and Spreads

What are Lowest Spread or Cipher Spread Brokers?

The Lowest Spread brokers offer the lowest Forex Spreads or null spreads. Trading costs declined over the contempo years as forex brokers compete to win more than clients. Many offer zero spreads as an extra enticement, merely it is essential to know the terms and conditions before choosing a broker. Our guide covers everything you demand to know, and then read on. Read more on spreads at Wikipedia.

The Lowest Spread for the EURUSD pair ranges from 0.1 – 0.9 pips with no commission charge. However, you should check all fees including, overnight fees, commissions, non-trading fees, deposit or withdrawal fees, and inactivity charges.

Top x Lowest Spread Forex Brokers

Based on our research, here are the best lowest spread brokers or nothing spread brokers.

- Pepperstone – Overall Lowest Spread Forex Banker

- AvaTrade – Stock-still Tight Spreads Forex Broker

- FP Markets – Ultra-competitive Spreads Broker

- IC Markets – Raw Spreads Account Forex Broker from 0.0 Pips

- Forex.com – Best Execution Low Spread Forex Broker

- FXTM – High Leverage Tight Spreads Broker

- eToro – Great Copy Trading Forex Banker

- IG – No Commission Banker

- FxPro – 0 Spread Forex Banker

- Fusion Markets – Low Commission Forex Banker

Compare Forex Costs per 100,000 Traded

| # | Forex Broker | Spread | Pips on Majors * | Established |

|---|---|---|---|---|

| 1 | Pepperstone | Variable | from 0.seven | 2010 |

| 2 | AvaTrade | Variable | from 0.9 | 2006 |

| 3 | FP Markets | Variable | from one.4 | 2005 |

| 4 | IC Markets | Variable | from i.0 | 2007 |

| v | Forex.com | Variable | from 1.0 | 2006 |

| 6 | FXTM | Variable | from 0.4 | 2011 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You lot should consider whether you lot understand how CFDs work and whether you lot tin afford to take the high risk of losing your money

one. Pepperstone – Lowest Spread Accounts and All-time Overall

All things combined, Pepperstone is our winner equally the best broker with the tightest Forex Spreads and no commissions. Their Standard Business relationship offers low average spreads from 0.6 pips for the EUR/USD pair and no commission trading fees. Their Razor account offers spreads from 0.0 – 0.3 pips + EUR 5,23 round turn per 100k traded.

Pepperstone Quick Facts

Pepperstone is a safe and reliable forex trading platform, trusted by many traders across the earth. Peperstone offers fast execution speeds and on the pop Metatrader 4, Metatrader 5, and cTrader platforms. Their client service is 1 of the best in the industry.

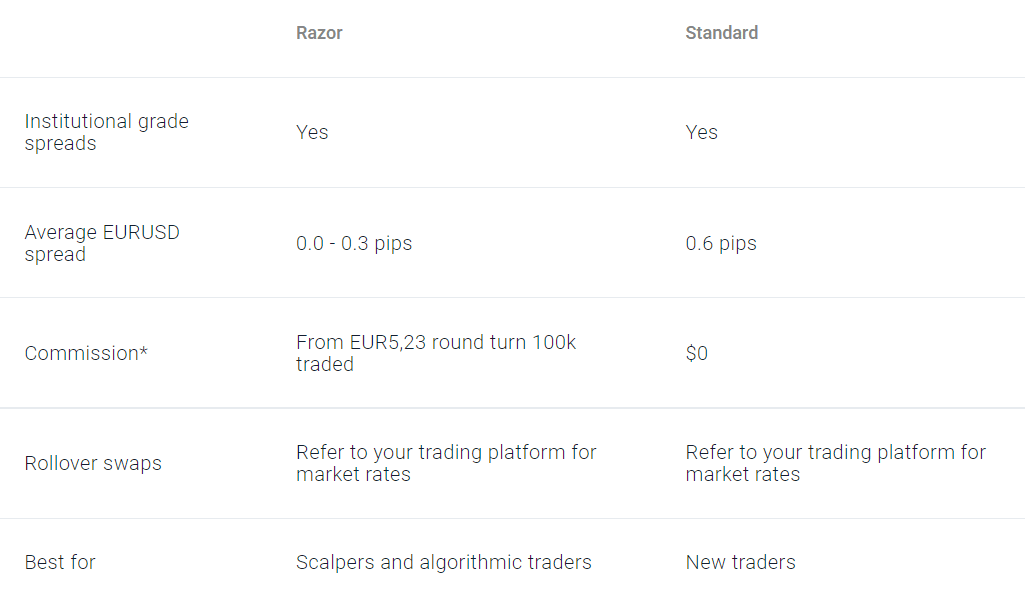

Pepperstone Accounts

Pepperstone offers 2 business relationship types. The Razor account and the Standard account. The Standard account is keen if you are a casual trader and don't want to pay commissions. What sets Pepperstone apart from the competition is they offer competitive spreads for both the standard and ECN pricing accounts.

For frequent traders that wish to relish competitive spreads, their Razor business relationship is a good choice.

CFDs are complex instruments and come with a high risk of losing coin rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you lot can beget to take the high risk of losing your coin

2. AvaTrade

AvaTrade is an splendid banker for active traders. They offering competitive fixed spreads of 0.9 pips with no commissions. The minimum eolith is $100 to open a an account with AvaTrade. They offer access to their proprietary platforms besides every bit both MT4 and MT5. On the downside, they charge above average inactivity fees.

| Pros | Cons |

|---|---|

| Highly competitive rates of 0.nine pips | Inactivity fees |

| Wide range of currency pairs | |

| Easy account opening process | |

| Gratis deposits and withdrawals | |

| Peachy research tools |

3. FP Markets

Beginning Prudential (FP) Markets is some other excellent pick. They are a well-regulated and trustworthy forex broker. They offer consistently low spreads starting at 0 pips and averaging around 0.45 pips. It offers admission to a range of tertiary-party platforms for you to choose from also as an impressive selection of educational content.

On the downside, FP Markets isn't available to US citizens.

| Pros | Cons |

|---|---|

| Spreads starting at 0 pips | Not available in the United states |

| Wide selection of platforms | |

| Educational resource | |

| Fast order execution |

4. IC Markets

With an average spread of 0.1 pips, IC Markets has ane of the best spreads on this listing. IC Markets fast order execution arrive a top pick for scalpers and algorithmic traders. IC Markets has no deposit or withdraw commission fees. Plus, customers get access to powerful platforms including cTrader, and MetaTrader. IC Markets' Raw Spread Account features cypher spreads + commissions.

A downside is that in that location is a high minimum eolith required to open an business relationship.

| Pros | Cons |

|---|---|

| Average spreads of 0.1 pips | High Minimum account deposit |

| Fast order execution speed | |

| No withdrawal or deposit fees | |

| Powerful platform |

five. Forex.com

Forex.com is one of the top-rated brokers in the US. This is another safety and reliable selection. Forex.com gives you access to 80 currency pairs. Although spreads are low, there is a flat commission rate of $5 per standard lot. It offers three premium platform equally well as the popular MT4 platform.

A downside is that passive traders will confront inactivity fees. There is also a long waiting period for account verification.

| Pros | Cons |

|---|---|

| Acme-rated broker | Inactivity fees |

| Low fees | Long business relationship verification waiting menstruation |

| Diverse inquiry tools | |

| Great range of currency pairs | |

| Admission to premium educational resources |

six. FXTM

ForexTime (FXTM) is another reliable selection for both experienced and beginner traders. With a great selection of account types, FXTM offers traders spreads starting at 0.1 pips.

FXTM gives clients access to over 200 markets which includes 48 currency pairs. It stands out for its fantabulous customer service and educational tools.

On the negative side, FXTM charges high CFD fees. There are as well inactivity fees and withdrawal fees.

| Pros | Cons |

|---|---|

| Spreads from 0.ane pips | High CFD fees |

| Responsive client service | Inactivity and withdrawal fees |

| Extensive educational tools | |

| Fast account opening process |

What is Spread in Forex?

The spread is the difference between the ask and bid price on a trade. A low value ways that at that place is a modest deviation between the bid and the inquire price of a currency pair. An increase usually means that there are volatile market atmospheric condition or liquidity in the marketplace. Spreads usually widen during less frequent trading hours, volatility, or before news events.

The interbank market is where the prices originate from for well-nigh of the major brokers. Spreads are quoted equally fractions of a pip (partial pips).

The spread is how no-commission brokers brand a profit. The cost is congenital into the bid-ask prices of each currency pair that you trade. This is done instead of paying a committee fee per merchandise. While some brokers annunciate lower spreads, they stop up being more than expensive, because they charge higher commissions. Because spreads change during time periods, it is best to calculate Average Spread information over a longer period of time (monthly spread data) and commissions (spread + commission). That is how yous avoid college average spreads.

How does Spread work in Forex?

The bid cost is the price at which you are willing to sell a currency and the price at which a broker is willing to pay for it. The enquire price is the price at which you buy the same currency and the cost at which a banker is willing to sell it. The bid price is generally lower than the enquire price. When you buy a Currency Pair from a broker, yous buy the base of operations currency and sell the Quote Currency. When you lot sell the currency pair, you sell the base of operations and receive the quote currency. Currency pairs are quoted based on their bid and ask prices.

A currency quote is the value of one currency compared to another foreign currency. These two currencies are known as the base of operations currency and the quote currency. The base currency is always the first currency listed. The 2d 1 listed is the quote currency.

How are spreads calculated?

Spreads are a key figure when determining your price. There are ii parts in how the spread is calculated. This price difference is calculated in pips. Pip stands for "pct in points". In Forex, ane pip is ordinarily equal to 1 point movement in market place value. This is based on the fourth decimal place of your currency pair.

First, there is an interbank spread. This is the price difference between the bank that wants to buy the currency at a set price and the selling bank offer.Second is the spread of the banker. Retail traders use brokers for lodge execution, so the banker adds a markup spread above the Raw Spread. The manner forex and CFD brokers make money depends on the available execution methods and their business model.

To calculate it, you need to work out the difference between the buy and the sell price in pips. All y'all need to practice is decrease the bid price of a currency pair from the ask cost.

i pip is equal to 0.0001 for nearly currency pairs.

An case of a ane pip spread for USD/EUR would be one.1061/i.1062.

How to Spread Bet in Forex?

Spread betting is merely available in certain countries like the United Kingdom. A spread bet is where traders "bet" on the direction of the price, upward or downwards. This way, spread betting brokers are a fashion to cut taxes for traders.

What is considered expert spread?

Spreads are considered practiced when they are every bit shut to zero as possible. Those usually have an average of beneath ane pip. An example of a good spread would exist 0.5 pips for a currency pair. It is also important to base your calculations on boilerplate cost data over a longer period of time.

What is the lowest spread in Forex?

0 pips is the lowest spread (zippo spread) in forex. 0 pips spreads are offered past ECN-STP brokers. In order to calculate which broker has lower spreads, it is important to calculate all trading costs. While some brokers offer zilch spreads, they still accuse per-trade commissions, which could end upward costing yous more than.

What is a zero spread business relationship?

Zero Spread Trading Account is a forex trading account that has no deviation between the bid and ask price or the spread is close to zero. Spreads can widen, depending on the trading weather condition, account type, and whether or not the broker charges commissions.

How To Compare Depression Spread Accounts?

To compare low spread forex accounts, y'all demand to have into account factors such as commissions per merchandise, spreads, trading platforms, regulation, security, and currency pairs offered.

Raw Spread Business relationship vs Standard Account

In Forex, a Standard Account refers to standard lot size which is 100,000 units of currency. A Raw Spreads account refers to the cost where the broker doesn't add together a price markup just offers the price directly from liquidity providers.

How does a practiced spread make a difference?

The lower the spread, the cheaper information technology is to place a merchandise gild. It means that the cost of trading is less. Incorporating spreads into your strategy is a key mode to make college profits.

On the other hand, make sure you check what other commissions your banker charges. Some charge college commissions to make a profit.

Scalping and Spreads

Finding a broker with low spreads is pregnant for scalping. Scalping is a strategy that involves profiting off of small cost changes. Equally a result, traders brand a high number of trades. Traders need fast order execution and a strict exit strategy as one large loss could erase the many pocket-sized gains made.

Source: https://www.publicfinanceinternational.org/lowest-spread-forex-brokers/

Posted by: canadacoundtowned.blogspot.com

0 Response to "Low Spread Forex Brokers Scalping"

Post a Comment