nadex binary options contacts to risk

Binary options are short-term, express gamble contracts. On Nadex, you tin trade binary options with different strike prices based on the possible probability of the issue. Acquire how to trade binary options and the ways y'all can use these contracts in your trading plan.

Binary options trading is a process, and the traders who are successful have their own plans and strategies. This procedure can be cleaved down into v central stages – information technology'southward important to follow each one advisedly if you're going to become a successful binary options trader.

How to trade binary options in v steps

-

Know the market trends.

-

Choice the market y'all want to merchandise.

-

Select a strike price and expiration.

-

Identify your trade.

-

Wait for expiration, or close out your trade early.

1. Know the market trends

Binary options trading is a elementary process of choosing a strike based on a yes or no question: will this market be above this toll at this time. If you lot remember yes, you buy. If you recollect no, you sell.

That'due south the like shooting fish in a barrel part. However, you need to go into your trading with market knowledge and clear predictions – otherwise, how can you answer that simple question? Every trader has their ain opinions and predictions, based on their perceptions of what's already happened, what's coming up, and what they think this means for time to come market movements.

Of class, nobody can encounter into the future, and even trading experts who've been diving into the markets for years can't say for certain what volition happen. But what you lot can practice is make strong predictions; market place forecasts and financial events are ever open to interpretation. It's up to you as a trader to put your own spin on things.

One of the nearly interesting aspects of fiscal markets is their relevance to the wider world. The events that affect our everyday lives – politics, current diplomacy, international relations, business organization developments, technology releases, and much more – tin also affect the markets.

To be a well-informed trader, y'all outset need to be a well-informed private, with a proficient overview of world events and what they mean for the economy.

This means staying up-to-date with the news, following world affairs, and learning how these can affect markets. Here are some ways to get started:

-

Follow Nadex on Twitter, Instagram, and Facebook.

-

Learn how to behave your own technical analysis.

-

Utilize the Nadex charts available in the platform.

-

Explore fundamental analysis and what this can tell you nearly the markets.

-

Attend a Nadex webinar on market place analysis.

-

Follow financial news and monitor the economic agenda.

2. Option the market you want to trade

In one case you know your markets, you're prepare to pick the ones you want to trade. This will depend on a whole host of factors, including:

-

Contract duration – markets may have intraday, daily, or weekly binary selection contracts available to buy or sell. Run across Nadex Binary Option contract specifications for stock indices, forex, commodities, and events.

-

Choosing the right level – it's all about finding the ideal strike, meaning you'll need to pick a marketplace that offers the right opportunities according to your trading program. More on that in the next step!

-

Personal interests – sure markets will capture your interest more than than others. Perhaps you're interested in United states politics and the way they can motility the dollar? Maybe you like to focus on oil, and the complex issues surrounding supply and demand? Each trader tends to go more captivated in particular markets that match their own interests.

On Nadex, you have a choice of four markets:

-

Stock indices

-

Forex

-

Commodities

-

Events

Learn more virtually the markets you lot tin trade on Nadex, so you tin find the ones that offer the right opportunities for you.

3. Select a strike cost and expiration

Selecting your strike price tin be one of the most challenging aspects of trading binary options when you're starting out. The contracts themselves are structured very simply, but that doesn't hateful the trading process is easy: you need a plan, a strategy, and a prediction.

While there's ever the possibility of losing money equally a trader, this outcome is far more likely if you jump into binary options trading without thinking information technology through.

The key to selecting a binary selection strike comes down to two main factors: probability and risk. It's a balancing act, requiring you lot to find a strike where you believe the outcome is possible, and y'all're comfortable with the level of trading risk y'all're taking on, also.

To become a crude idea of probability, just notice the mid-signal between the contract's bid and offer price – the prices that sellers and buyers are paying, respectively.

Permit's look at an case of the strikes available for a five-minute binary option contract on EUR/USD:

What would be the thought process backside picking betwixt these strikes? Why would ane be more than highly-seasoned to you than another?

You need to bring your market predictions to the table and call up analytically. When looking at each strike, focus on the probability and risk angle: do you recall the strike is achievable, and if so, is it the correct price level for you?

Looking at the strikes available, the bottom one is in-the-coin (ITM). Using the method of finding the midpoint, you become 63 – this means there's around a 63% probability of EUR/USD being higher up 1.0865 in three minutes and 48 seconds. The probability of it remaining in-the-money is higher, so the cost is higher, too.

If, however, you think the market is probable to reverse and motion below the strike of >1.0865, you also accept the option to sell the contract – and the profit y'all'd stand to make from this is higher, because the probability of that happening is lower.

The same goes for each of the other contracts; y'all need to consider the hazard and reward. You could purchase a contract with a strike of >i.0867 for a price of $37.50, meaning a potential profit of $62.50. Even so, the probability of this happening is just around 35.25%, as this is the midpoint between the bid and offer cost.

This is just one example, covering one market and selection duration. Binary option contracts are available with five-minute, twenty-minute, 2-hour, daily, and weekly durations. This gives you an additional option to make when picking your market; information technology will depend on your trading style, the markets you favor, and the economic events coming up. Durations can clearly exist seen next to each underlying market in the Nadex platform.

4. Place your trade

Once y'all have decided on your strike, it's a uncomplicated process to place your trade. When yous click on the strike, either at the left-hand side of the screen or on the nautical chart itself, your order ticket will be brought upwardly.

You lot tin click between the buy and sell buttons, and cull whether y'all're going to place a limit order or a market club. You'll besides need to fill up in the size box, which is the number of contracts yous desire to buy or sell. Toggle between them and explore your options – you'll clearly see your maximum potential profit or loss calculated underneath.

When you're ready, simply choose identify order.

5. Look for expiration, or close out your merchandise early

If y'all've placed a market order in a liquid market place, it should be filled immediately and will show up in the 'positions' window at the bottom of your screen. If you've placed a limit order, you may demand to wait and come across if this is filled. In this example, information technology will show in the 'orders' window. If it'south filled at the price yous accept selected, it will movement into the 'positions' window. From hither, y'all'll be able to monitor your trade until expiration.

Trades don't always go equally planned (and that's why yous should only e'er trade with capital you can afford to adventure). If you find that the markets are moving confronting you, though, the other option is to close out early and limit your losses. Equally, you might detect that the markets are moving in your favor and cull to close out early on, taking a smaller confirmed profit. If y'all await until expiration, the markets could move against you, risking your contract settling at 0.

Accept a await through the examples below to run into how this works in practice.

Binary options trading examples

You've followed our step-by-stride guide, showing you how to trade binary options from get-go to finish. And so what almost the consequence? Hither are some trading examples, worked through from start to finish, showing you lot how to merchandise binary options in a real-life scenario.

Binary option trading example no. one: closing out early

Closing out early is an pick if you lot want to secure your profit at the current market toll, or limit losses if your trade isn't working out for you.

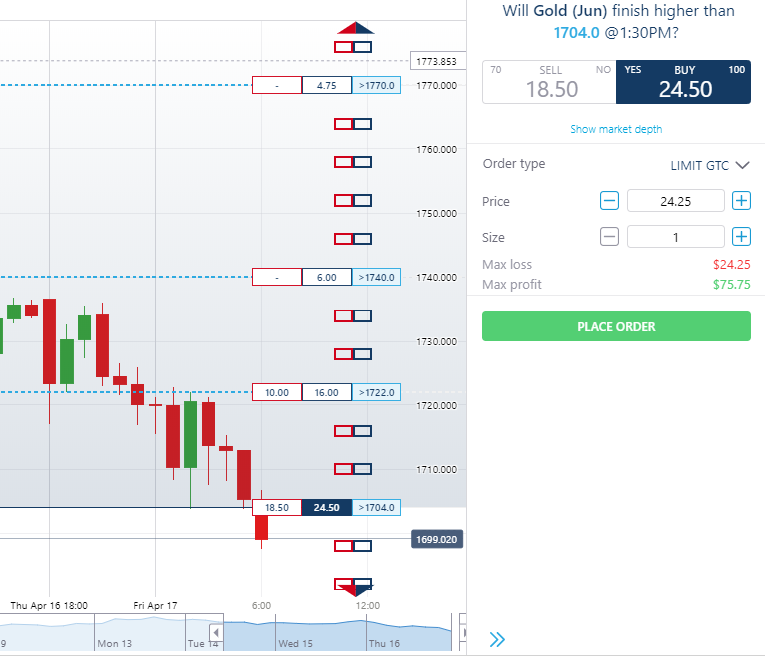

In this case, you determine on the commodities market, and want to identify a merchandise on gilt. There'due south a great deal of market volatility, and as aureate is usually a safe haven, yous think the market may motility college – it's been trading down all morning.

The toll of a binary option contract is typically based on the likelihood of a particular outcome happening. The Golden (Jun) contract >1704.0 @ i.30 p.one thousand. has an offer price of $24.50, giving a risk-to-reward ratio of more than than 3:one.

The market would have to move quite significantly to achieve this – by buying this binary option, you are predicting that the price of golden will be higher up 1704.0 at 1.xxx p.yard., fifty-fifty though information technology's currently only 1699.020. However, if the contract is the right level co-ordinate to your trading plan, you may purchase this contract for $24.l at 6:32 a.m. (knowing you tin can ever close out early if the market rallies or starts to fall).

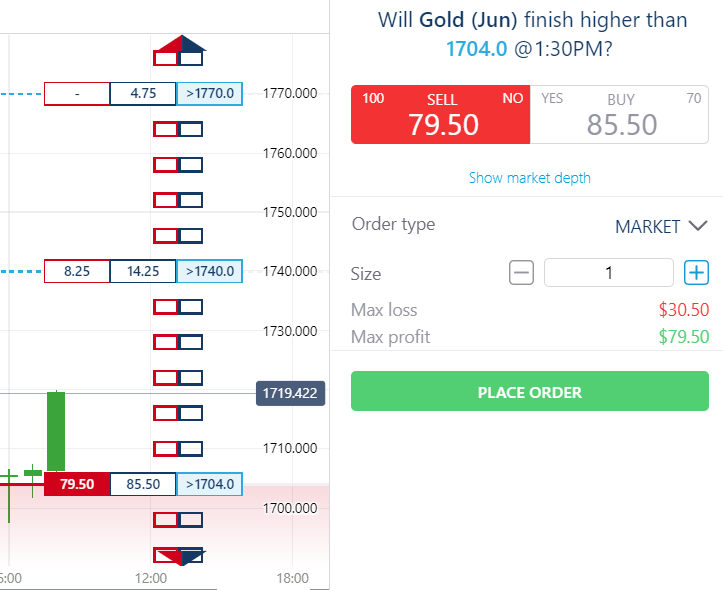

At viii:53 a.thou., the market has rallied to 1719.316. This puts you lot comfortably in-the-money, and you lot decide you'd similar to take your profits, in example the market reverses – after all, in that location is notwithstanding a long time to go until expiration. The sell price is $79.50, so y'all cull to sell i contract using a market place order to starting time your earlier purchase order.

You lot bought for $24.50 and sold for $79.l, and $79.l - $24.50 = $55.00. This means you've made a turn a profit of $55.00 on this trade, excluding exchange fees.

Binary option trading case no. 2: trading five-infinitesimal binaries

Earlier, we touched on five-minute binary choice contracts and the dissimilar merchandise set-ups. Allow's see what the event of a trade would have been at expiration, for all possible scenarios.

These were the strikes available with iii minutes and 48 seconds until expiration:

The expiration value was ane.08679. These would have been the outcomes for each strike, based on ownership or selling with three minutes 48 seconds until expiration:

| Strike | Buy outcome* | Sell event* |

| >1.0873 | 0 | $0.25 profit |

| >1.0871 | 0 | $2.25 profit |

| >1.0869 | 0 | $xi.25 profit |

| >1.0867 | $62.50 profit | 0 |

| >1.0865 | $34.75 profit | 0 |

*Excluding exchange fees. Note: exchange fees would have made the 1.0873 strike an unprofitable outcome overall.

Learn more about how to trade v minute binary options.

Binary choice trading case no. 3: belongings the contract to expiration

If you are confident in your trade and think the markets will prove you correct, y'all may choose to hold your trade until expiration.

For this example, allow's look at a binary option contract based on the The states 500 index.

You lot think the index could move higher, and run across there has been a potent upward move the previous day – plus, the index has been trading higher all forenoon. However, in that location is still some turbulence, so you don't desire to risk besides much capital letter on a contract – you're concerned the marketplace could reverse and move against yous.

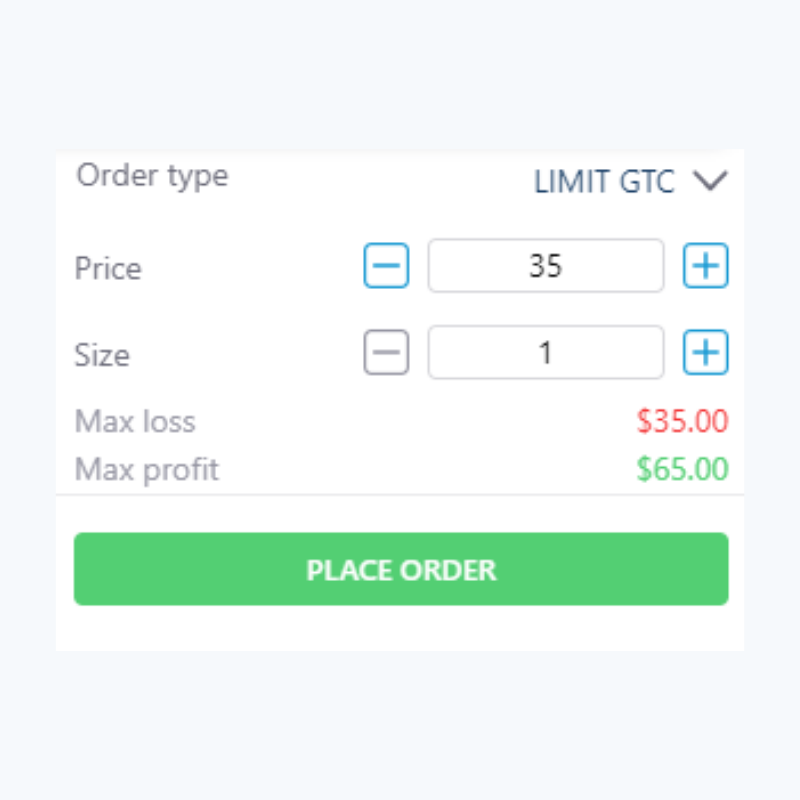

You pick the strike >2846.ix (10 a.thou.), meaning you think the underlying market will be higher than 2846.9 at 10 a.m. The market price is $xl.25, however yous don't want to pay more than than $35.00, then you lot enter this figure into the 'price' box and place a limit order to buy at 9:31 a.m. The lodge is filled at 9:32 a.k.

As yous tin see from the order ticket, your maximum loss is $35.00 (the amount you paid to enter the trade), and your maximum profit is $65.00, excluding fees.

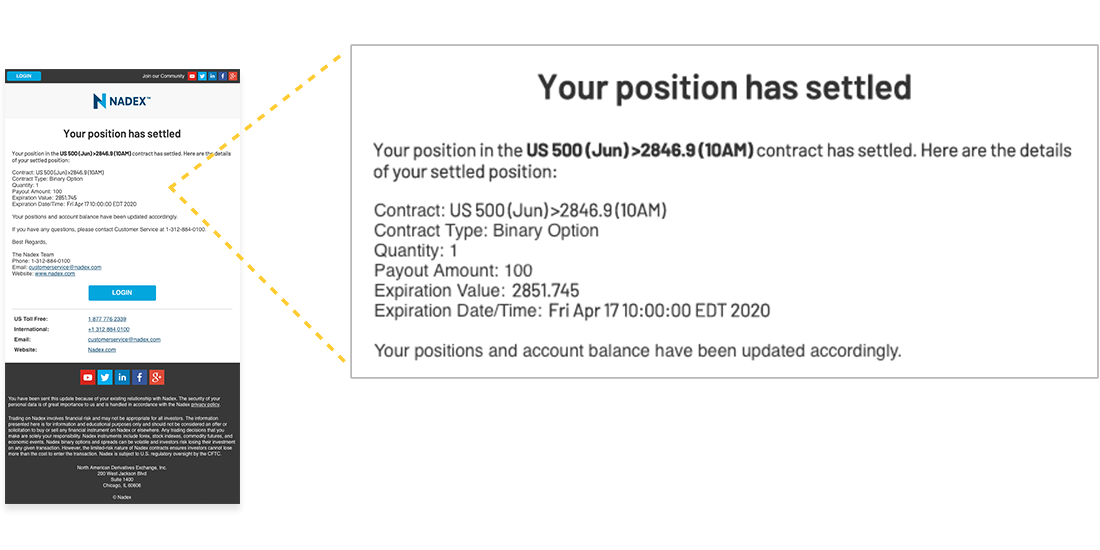

At 10 a.m., you receive an e-mail telling you lot that your position has settled.

The expiration value is higher than your strike of >2846.9, meaning your prediction was correct and your payout amount is $100.00. This means you make a turn a profit of $65.00, excluding fees.

How to trade binary options: farther learning

By now, you should have a good understanding of the binary options trading process, as well as a good thought of how to make your own decisions (based on your personal trading programme). Earlier y'all can outset trading binary options, you'll need to know your way effectually the platform – why not check out the platform tutorials in our learning eye?

Farther reading:

What are binary options and how do they work?

How to read candlestick charts

What is a strangle strategy using binary options? (This is a more than advanced strategy to try out when you're feeling confident in how to trade binary options.)

Once you know your way around the platform and empathise how binary options work, it's time to practice! Download your Nadex demo account and start practicing - $10,000 in virtual funds are waiting for you.

Binary Options FAQs

What are binary options?

Binary options are a financial instrument that provide a fixed payout if the underlying marketplace moves beyond the strike cost. Y'all make up one's mind whether a marketplace is likely to be above a certain price, at a certain time. Trading a binary option is like request a simple question: volition this marketplace be above this price at this time? If y'all recollect yes, you purchase, and if yous think no, you lot sell. Nadex Binary Options enable traders to predict the outcome of an underlying market's move. Larn more about how binary options piece of work.

How do binary options work?

There are three key elements that brand upwardly a binary option contract:

-

The underlying market. This is the market you choose to trade.

-

The strike price. The strike price is central to the binary pick decision-making process – to place a trade, you must make up one's mind if you call back the underlying market will be above or beneath the strike.

-

The expiration engagement and fourth dimension. Y'all tin can trade binary options lasting for up to 1 week, with durations as brusk as five minutes.

Learn more than about how binary options work.

Are binary options legal?

Yes, binary options are legal to trade with a regulated provider in the US. It's not just legal to merchandise binary options in the Us – it'southward regulated, has low capital requirements, and is accessible to retail traders. Look out for CFTC regulation to brand certain the substitution y'all are trading on has legal oversight to protect you against unscrupulous market practices. Additionally, ensure the substitution is based in the Us and that you trade your own account. Larn more about how binary options are regulated.

Is binary options trading risky?

It can be! Here are some steps to follow and then that you tin trade binary options more securely:

-

Only trade with a CFTC regulated substitution.

-

Don't engage with anybody who claims to be a broker, or who says they can trade your account for you.

-

Trade your ain account.

Try trading binary options on a regulated exchange for complimentary! The best way to trade more confidently is through practice on our binary options demo account with $ten,000 in virtual funds.

How do binary traders make money?

Binary traders can make money by correctly predicting whether a marketplace volition be above a specific cost at a specific time. At expiration, yous either brand a predefined profit or yous lose the money you paid to open the trade. Binary options are priced between $0 and $100. Each contract will prove you the maximum you could proceeds and the maximum you could lose. If your trade is successful, y'all receive a $100 payout, and so your profit will be $100 minus the money you paid to open up the trade. If your merchandise isn't successful, you don't receive a payout. This ways y'all lost your capital, but zilch else, because your risk is capped.

What'south the difference between options and binary options?

Binary options are short-term, limited risk contracts with two possible outcomes at expiration – you lot either make a predefined turn a profit or you lose the money you paid to open the trade. The payoff is fixed on either side of the strike cost. Options, besides called vanilla options, accept a payout that is dependent on the deviation of the strike cost of the selection and the price of the underlying asset on one side of the strike price while fixed on the other. Options can be circuitous, difficult to price, and have the potential for outsized profits or losses.

What'southward the minimum deposit for a binary options trade?

At Nadex, yous can open up a live account for gratis - that'due south right, no minimum eolith required. Binary trades at Nadex are priced betwixt $0 and $100, excluding exchange fees. The toll to identify a merchandise is always equal to the maximum risk, plus any merchandise fees, which is required to be in your account when the club is placed. Not set for a live account? You tin can practice trading binary options for free with our binary options demo business relationship.

Source: https://www.nadex.com/learning/how-to-trade-binary-options/

Posted by: canadacoundtowned.blogspot.com

0 Response to "nadex binary options contacts to risk"

Post a Comment